When spending abroad on your Amex a charge of 2.99% is applied to their base rate per transaction. While the exchange rate changes throughout the day, American Express sets a single daily benchmark rate, and at a relatively high rate, so if there are movements in your favour you won’t benefit. We had a look at data from August to December 2019 for travellers spending on their UK Amex in both Euros and American Dollars, and the average margin added to the base rate fee was 0.5%. Ultimately, the total charge for using your Amex abroad is 3.5% per transaction.

Currensea travel debit card

Currensea the UK's best rated travel debit card gives you access to the best rates at only 0.5% above the FX base rate on the Essential plan, saving you at least 85% on every transaction, and 0% on the Premium and Elite plans, saving you 100% in FX fees on every transaction.

By opting to use your Currensea travel debit card abroad in favour of your Amex, you will have an FX charge reduction of at least 3%. If you’re abroad for a week, this difference can quickly add up. So, how many Avios could you buy with your savings?

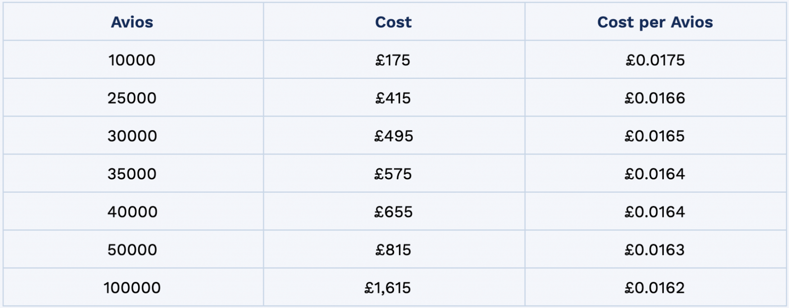

When calculating Avios prices we will use the most expensive per point price, so if you save up your Currensea travel debit card savings and buy in bulk you could get more miles for your money.

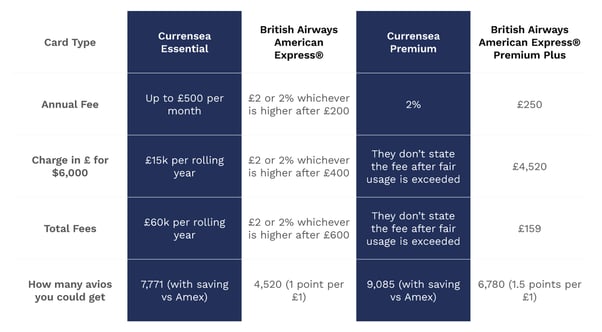

The blue British Airways Amex card is the entry-level card for collecting Avios, there are no annual fees associated with the card and you earn a flat rate of 1 Avios per £1 spent.

If you spent $6,000 abroad (£4,520 including Amex fees) you will receive 4,520 Avios. The total fee of this transaction is £159, however, if you used your Currensea essential card the total fee would be £23 - a £136 difference. With this difference, you could’ve bought 7,771 Avios or 72% more.

If you’re an active collector, the Premium BA card may be your preference. While there is a £250 annual fee for this card, you will receive 1.5 points per £1 spent, as well as 3 points for every £1 spent with BA.

If you spent $6,000 abroad (£4,520 including Amex fees), you will receive 6780 Avios. Even with an increase in points, your savings would’ve bought you 15% more Avios than through using your Amex abroad.

The below table shows you the price and fee breakdown for Currensea Essential, Currensea Premium, British Airways American Express® Credit Card, and British Airways American Express® Premium Plus Card.

Regardless of which card you are using it is always best to use your American Express card when you are in the UK so that you can collect points on your everyday spending. However, when you are abroad the best collection strategy is to use your Currensea travel debit card and purchase Avios with your foreign exchange savings vs Amex.

If you spend a lot throughout the year, it is worth considering upgrading to a Premium Plus Amex. Upgrading offers the added benefit of an extra 0.5 points per £1 as well as an extra 2 points per £1 spent directly with British Airways. The other benefit of premium is that your Companion voucher (earnt after £10k spent per year or £12k on the standard card) is valid for 24 months in any cabin, whereas the standard card companion voucher is only valid for 12 months and in economy class only.

If you travel a lot it is also worth spending £25 to upgrade to Currensea’s travel debit Premium Plan as you will save 100% on foreign exchange fees every time you travel - all the more to spend on buying Avios if you so wish.

Currensea Limited is registered in England and Wales (No. 11413946), authorised by the Financial Conduct Authority (Reference No. 843507) and is a Principal Member of Mastercard. We are registered with the Information Commissioner's Office (Registration No. ZA524676).

© Currensea Limited 2022